Ancestry® Family History

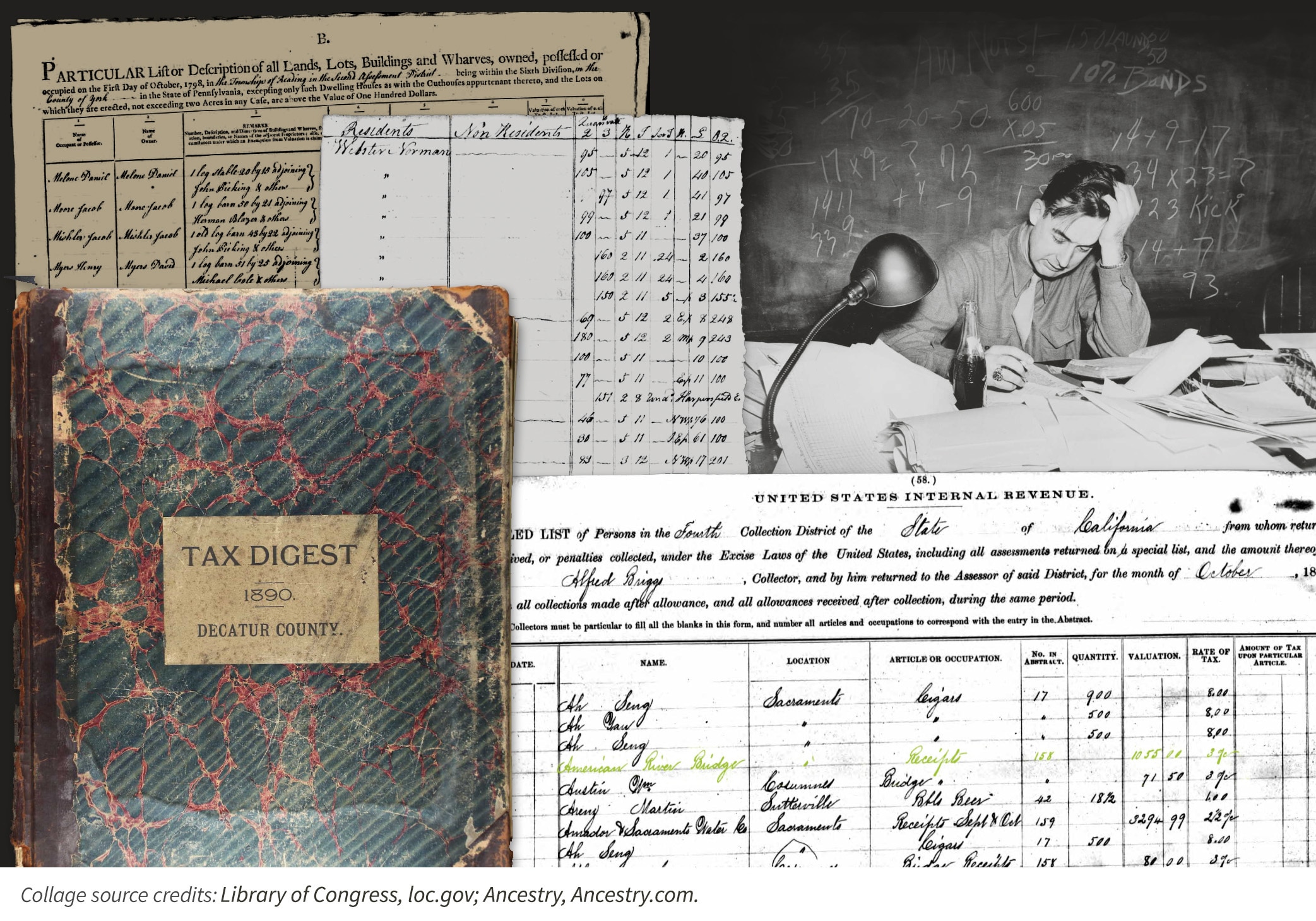

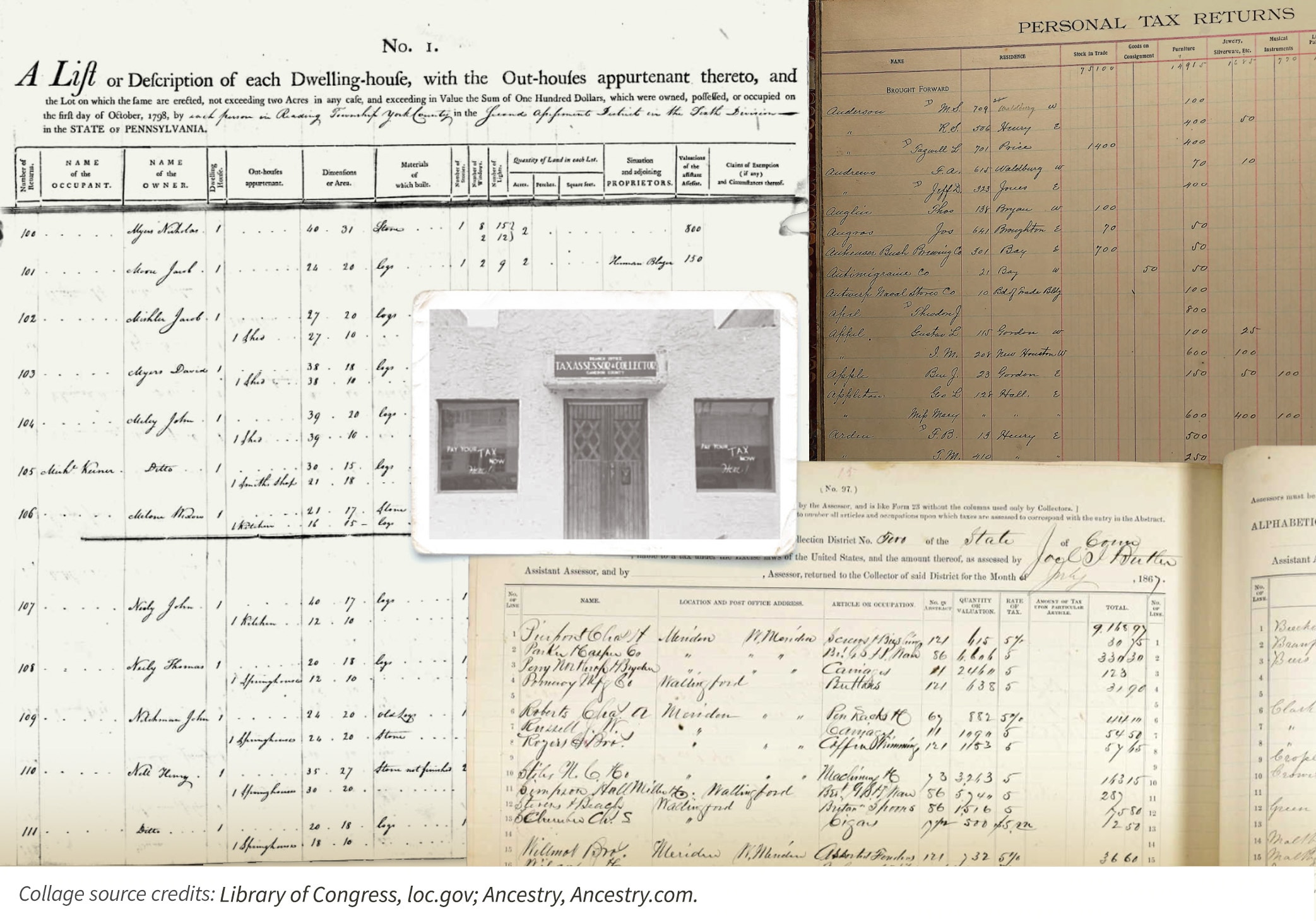

Historical Tax Lists

As April Tax Day rolls around each year, U.S. taxpayers compile and file financial records to document their previous year’s income. Property owners throughout the states must also pay taxes on land and dwellings during the year. Although paying taxes isn’t the most enjoyable aspect of our lives—and our ancestors likely felt the same way—the information left behind in these records can be a veritable treasure trove for family history researchers.

For example, you may discover the type and size of dwelling your great-great-great- grandfather lived in with his family during the late 1700s in Pennsylvania.

You might learn that your family in Georgia paid tax on hickory and oak trees, a four-wheeled “pleasure carriage,” a musical instrument, or a billiard table in the early 1800s.

Or you may even uncover an economic decrease—in income or property—for your Kansas relatives between 1929 and 1939, meaning they likely suffered hardships during the Great Depression or because of the Dust Bowl.

What Are Historical Tax Records or Lists?

Historical tax records can document a variety of situations, including when a person or business paid taxes and what they were taxed on. Examples include:

- Property Taxes: This type of tax is calculated by a local government, as it’s connected to the location of a property.

- Excise Taxes: These are imposed on specific goods by the federal government, notably alcohol and tobacco products.

- Income Taxes: The federal government has collected income tax since the Civil War.

The types of taxes paid or assessed throughout history can vary depending on many factors, and not all records across all states contain the same information.

When Did Americans Start To Pay Taxes?

Starting in the 1600s, as a British colony, settlers were subject to taxes levied by the British government. During that time, each colony also established separate property, poll, and excise taxes, for example.

By the early 1770s, however, the British government’s imposition of additional taxes on staples like sugar, paper, glass, and tea caused outrage in the colonies. Colonists’ frustrations boiled over about this “taxation without representation,” and on December 16, 1773, the political protest that became known as the Boston Tea Party took place. It was one tipping point that led to the American Revolution.

As national security needs increased for the new United States of America, so too did the need for more tax revenue. In order to raise funds to strengthen the U.S. military, the Direct Tax of 1798, the first federal direct tax, was levied on those who owned land, dwellings, and enslaved people.

How Were U.S. Taxes Collected Before the IRS?

Before the development of the IRS, taxes were collected by state or county representatives. States would then send the monies collected for federal taxes to the federal government. For family history researchers, this means that state and county tax records can be an excellent source of information.

However, it was historically challenging to collect taxes because no widespread systems were in place. Instead, a tax collector (also known as a "tax farmer") would go from person to person or building to building for collection purposes.

The first federal American income tax was enacted through the Revenue Act of 1861. Its primary purpose was to support the financial requirements of the American Civil War. At that time, a flat 3 percent tax was placed on any income over $800, although this would later be changed to include a graduated tax rate for those who made significantly more than $800.

Once the U.S. Congress passed the Internal Revenue Act on July 1, 1862—an expansion on the one from 1861—the Bureau of Internal Revenue (which would later become the Internal Revenue Service) began collecting and recording federal taxes due and paid.

Types of Tax Records

Land tax is one kind of record for family history researchers to explore. These 18th- and 19th-century tax documents are similar to today's property tax accounts. Then, as now, property taxes were used to pay for community expenses like schools. Historical land or property taxes were often only enacted at the local level, but by 1796, 14 states (out of 15) had land taxes in place.

A personal property tax was historically levied during these earlier time periods, too. Only certain classes of property and possessions were subject to the tax, which included (among others) farm animals, investments in mining, shares held in banks, and jewelry. Before slavery was abolished in the U.S., slave owners were also charged taxes on their enslaved persons, as they were considered “property.”

Other types of historical taxes and tax records include:

- Income taxes levied by local, county, state, or federal governments directly against a person's income

- Direct taxes imposed by federal and state governments on people or property, including income and capital gains taxes

- Excise taxes levied on manufactured goods directly after creation (versus at sale)

- Tax assessment lists, also known as tax rolls or tax digests

- Taxpayers lists that generally only contained people who failed to pay their taxes and were in debt

What Information Can Be Found in Historical Tax Rolls?

Clues in U.S. historical tax records may not only shed light on your ancestor, but you might also learn more about the community and time in which they lived.

Examples of information you might discover include:

- Where your relatives lived before or between federal census years

- The ages of all household members, which can help determine birth years

- The economic well-being of individuals, as noted from personal property descriptions

- The type and size of home someone lived in, and whether they had other dwellings like a separate kitchen or barn

- Changes in head of household status, such as the appearance of “Widow Elliott” instead of “John Elliott”

But what can be most interesting are the unexpected bits of information you may uncover. For instance, if your ancestor was listed in 1860 and 1870 U.S. census records as a shopkeeper or tavern owner in Connecticut, you might also find him on the excise tax rolls. You may even discover that he was stocking up on watches or tobacco in June 1869.

How Economic Events Might Appear in Tax Records

Tax records could also show a significant rise or fall in your ancestor’s economic status. What can make this status change notable is its potential connection to historical events like the Great Depression, the Depression of 1893, the Panic of 1837, or the Panic of 1819.

For example, you might find that a relative was doing well in 1891 or 1892. But, that same relative was reported to have a lower income, less personal property, or be behind on their taxes in 1893 or 1894. Using this information, you might surmise that they were negatively affected by the Depression of 1893.

Why Might Some People Not Appear in Historical Tax Lists?

Not everyone is included in historical tax lists and documents. Historically, certain people were exempt from paying taxes during various periods.

One of the most common 18th-century tax records you might find during your family research, for example, is a poll, tithable, or head tax. These records can usually help trace a patriarchal line much further back than census documents. However, they generally only list the adult white males who lived within a household, as those were the "heads" who paid the tax. Nevertheless, widows were made to pay taxes if they owned property, so it can be possible to find records on female taxpayers.

In general, historical tax records may be of less value to you if you’re searching for a relative who was:

- Female

- A veteran

- A minister

- An older white male (above 50 or 60)

- A white person living in poverty or financial distress

- An enslaved person

Likewise, you may not be able to locate relatives who didn't own land. If your ancestors rented, were sharecroppers or tenant farmers, lived with another family, or had no permanent residence, they may not be in historical land tax records. But they could appear in personal property tax records, as those assessments included items like the number or type of livestock.

Where Might Other Tax-Related Information Be Found?

If you're finding it challenging to locate an ancestor in tax-related records—because the records no longer exist, for example—other documents might help you understand your family’s economic situation.

Be sure to review your ancestor’s appearance in the post-1840 U.S. census records, as those sometimes indicate the total monetary value of a person’s property.

Historical newspapers that cover the area where your ancestors lived might also provide some clues. If you believe an ancestor struggled to pay their taxes at some point, perhaps due to a massive drought-related crop failure, newspapers sometimes posted lists of delinquent taxpayers. You may even find an accompanying news story about the impact of that drought on the community.

Explore Historical Tax Assessments on Ancestry®

Ancestry® has a wide range of historical U.S.-related tax lists for different states and time periods. However, these records, while sizable, aren't exhaustive. Available documents vary significantly based on location, time frame, and the specific type of tax record.

Keep in mind that some states and counties may not have kept their historical records, while others were destroyed by natural events before digitization. In addition, some state or county record offices may not license their historical tax assessments for genealogy research purposes.

But still, plenty of records exist for family history researchers to review. In fact, the largest collection of U.S. historical tax records on Ancestry, the IRS Tax Assessment Lists, 1862-1918, has more than 8.8 million records.

At the state level, sizable collections include:

- Georgia, U.S., Property Tax Digests, 1793-1892

- Pennsylvania, U.S., Tax and Exoneration, 1768-1801

- Tennessee, U.S., Early Tax List Records, 1783-1895

- Ohio, U.S., Tax Records, 1800-1850

And if you’re looking for some of the earliest tax documents, Ancestry has several collections from the colonial period for North Carolina, Virginia, and Baltimore County, Maryland.

Explore Your Family History Through Historical Tax Lists

The details found in historical tax lists can offer unique insights into the lives of your ancestors. Paired with the frequency in which tax records have been prepared, historical tax records can be invaluable to your genealogy research. You may discover crucial context clues about your relative's economic status, home, and community, making your family story feel more alive and personal.

Join Ancestry today to learn more about your family's history and the communities in which they lived.

References

“American Colonies: British and United States History.” Encyclopaedia Britannica. March 21, 2023. https://www.britannica.com/topic/American-colonies.

“An Overview of Excise Tax.” Internal Revenue Service. June 21, 2022. https://www.irs.gov/newsroom/an-overview-of-excise-tax.

“Boston Tea Party.” History.com. March 28, 2023. https://www.history.com/topics/american-revolution/boston-tea-party.

Carlson, Richard Henry. “A Brief History of Property Tax.” Fair & Equitable. February 2005. https://www.iaao.org/uploads/a_brief_history_of_property_tax.pdf.

“Causes and Effects of the American Revolution.” Encyclopaedia Britannica. October 22, 2021. https://www.britannica.com/summary/Causes-and-Effects-of-the-American-Revolution.

"Colonial Tithables." Library of Virginia. Accessed April 20, 2023. https://lva-virginia.libguides.com/tithables.

Cosgel, Metin M. and Miceli, Thomas J., "Tax Collection in History.” Economics Working Papers. December 2007. https://opencommons.uconn.edu/cgi/viewcontent.cgi?article=1196&context=econ_wpapers.

Fisher, Glenn W. "History of Property Taxes in the United States." Economic History Association. Accessed April 20, 2023. https://eh.net/encyclopedia/history-of-property-taxes-in-the-united-states/.

Fontinelle, Amy. “A Brief History of Taxes in the US.” Investopedia. January 24, 2023. https://www.investopedia.com/articles/tax/10/history-taxes.asp.

Kagan, Julia. “Property Tax: Definition, What It's Used For, How It's Calculated.” Investopedia. April 13, 2022. https://www.investopedia.com/terms/p/propertytax.asp.

Lake, Rebecca. “What Is Personal Property Tax? Definition and How Funds Are Used.” Investopedia. March 2, 2023. https://www.investopedia.com/persoal-property-tax-5192669.

“Poll Taxes.” National Museum of American History. Accessed April 20, 2023. https://americanhistory.si.edu/democracy-exhibition/vote-voice/keeping-vote/state-rules-federal-rules/poll-taxes.

Watson, Judith Green. "A Discovery: 1798 Federal Direct Tax Records for Connecticut." Prologue Magazine. Spring 2007. https://www.archives.gov/publications/prologue/2007/spring/tax-lists.html